fresh start initiative irs reviews

4 5 Very good Fresh Start Initiatives goal is to help consumers restore control over all of their IRS tax debt issues. Married filing jointly and both spouses are under age 65.

Irs Tax Debt Relief Forgiveness On Taxes

The IRS held about 1000 special open houses to help small businesses and individuals resolve tax issues with the Agency.

. IRS Fresh Start Installment Agreements. As an online aggregator Fresh Start. Yes the IRS started its Fresh Start Initiative in 2008.

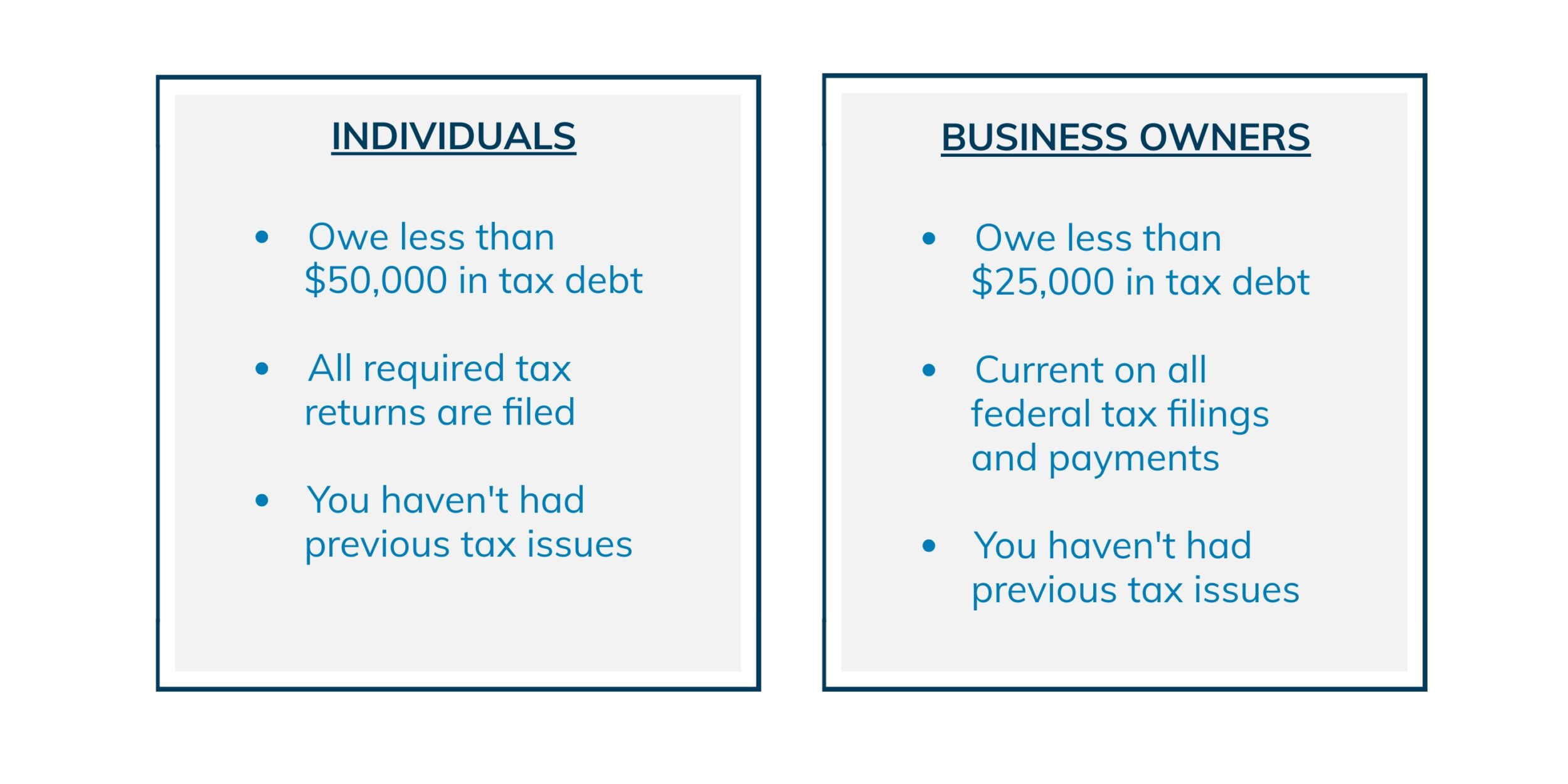

The IRS created the Fresh Start program in 2011 to help businesses and individuals facing difficulty paying their taxes. In 2011 it expanded the initiative to be even more beneficial to taxpayers who owe less than 50000 in unpaid taxes. The initiative also offers certain taxpayers the ability to have their debt partially forgiven if they make a good-faith effort to repay it.

To show good faith and responsibility a taxpayer should keep financial records in an organized manner. The service was established in 2014 and since then has served over 1 million visitors. The IRS began Fresh Start in 2011 to help struggling taxpayers.

If you have issues with a tax agency recommended by Fresh Start Initiative youll need to contact the agency directly. Depending on your situation you could be eligible for one or more of these programs. In 2008 the IRS came up with the Fresh Start Program to offer some concessions to taxpayers passing through a financial crisis.

For immediate assistance please call 888-626. The average consumer may feel overwhelmed or confused by their tax issues and they may not fully understand. Many advertisements also tout Fresh Start as an opportunity to settle back taxes with the IRS.

Fresh Start Initiative Review. Rated 45 5 out of 424 reviews. Single and age 65 or older.

There were two major announcements of changes to IRS collection policy. Their platform is completely free to use and offers a no-risk consultation. The IRS Fresh Start Program helps taxpayers who owe the IRS by aiding taxpayers with paying back taxes and avoiding tax liensIt is an irsgov payment planChanges implemented by the program largely revolved around tax liens installment agreements offers in compromise.

Government in 2011The Fresh Start Initiative Program offers tax assistance to a certain crowd of people who owe the IRS money. One Reddit IRS Fresh Start Program Review claimed with quite a bit of documented evidence that they were able to save 27000 thanks to the fresh start IRS initiative. Married filing jointly and one spouse is age 65 or older.

The IRS Fresh Start Program also known as the Fresh Start Initiative could be your ticket to tax debt freedom. The IRS Fresh Start Program is a catch-all phrase for the IRSs debt relief alternatives. This is more of an initiative rather than a program that undergoes frequent modifications.

Generally the IRS fresh start initiative reviews tell of a lot of hard work and time if you choose to do-it-yourself but whether you choose a professional or go it alone you. By giving the IRS these proofs a taxpayer proves not only facts but also trustworthiness which increases the chances of getting accepted to the Fresh Start program. That amount is now 10000.

Its updated guidelines can help both individual taxpayers and business owners in paying back taxes. It is the federal governments reaction to the IRSs predatory methods which include the use of compound interest and financial penalties to penalize. The Fresh Start Program also known as the Fresh Start Initiative was established by the US.

Todays announcement comes after a review of collection operations which Shulman launched last year as well as input from the Internal Revenue Service Advisory Council and the National Taxpayer Advocate. Fresh Start Tax Relief matches taxpayers who need help with tax resolution to a company that can meet their needs. Now to help a greater number of taxpayers the IRS has expanded the program by adopting more flexible Offer-in-Compromise terms.

See if you qualify. We highly recommend taking advantage of the free case review offered by our licensed tax partners. IRS Fresh Start Initiative.

Single and under age 65. As of the 2021 tax year the minimum gross income requirements are. Foreign-Derived Income and Assets.

The objective of the program is to make it easier for tax delinquents to legally escape their monetary difficulties. Others make it possible to pay off what you owe in. The Fresh Start program increased the amount that taxpayers can owe before the IRS generally will file a Notice of Federal Tax Lien.

If so the IRS Fresh Start program for individual taxpayers and small businesses can help. However in some cases the IRS may still file a lien notice on amounts less than. Depending on the Fresh Start route you take the program might reduce the amount you.

The IRS Fresh Start Program launched in 2011 is an initiative designed to make it easier for taxpayers to resolve tax debt by giving them a fresh start with the Internal Revenue Service. Generally if you owe less than 50000 to the IRS you can get into a repayment agreement by providing minimal financial information if that number is under 25000 you do not need to provide anything and if you are able to fully repay the debt in five years you can then request a lien be withdrawn. The IRS Fresh Start Program launched in 2011 is designed to make it easier for taxpayers to.

A large number of taxpayers fail to pay taxes to the IRS every year making them susceptible to various penalties and liens. In many cases tax problems are best solved by IRS enrolled agents CPAs or tax attorneys. The IRS fresh start program aimed to allow debtors to negotiate with the IRS on a payment plan that they feel is manageable for them without the stress and weight of an impending tax lien.

Married filing jointly and both spouses are age 65 or older. The Fresh Start Initiative grants more flexible repayment terms for taxpayers to pay or absolve their back taxes without incurring penalties. The Fresh Start initiative offers taxpayers the following ways to pay their tax debt.

The Fresh Start Initiative began as a series of significant IRS collection policy changes in 20112012 to help taxpayers who were struggling to pay their back taxes. Fresh Start Initiative Get Started. 27702 Crown Valley Pkwy D-4 130 Ladera Ranch CA 92694.

The programs goal is to help taxpayers get in good standing with the IRS. The IRS Fresh Start Program is an umbrella term for the various tax debt relief options offered by the IRS. Its focus is rehabilitation rather than punishment or penalty.

This expansion will enable.

Irs S Fresh Start Program Expands Payment Options

Fresh Start Initiative Review A Tax Relief Service Lendedu

Irs Fresh Start Program How It Can Help W Your Tax Problems

Do I Qualify For The Irs Fresh Start Program

Irs Fresh Start Program Makes It Easier To Settle Back Taxes Debt Com

Irs Fresh Start Initiative A Guide To The Fresh Start Tax Program

Irs Fresh Start Program Tax Debt Relief Initiative Free Consultation

3 Ways To Be Eligible For The Irs Fresh Start Program

Irs Fresh Start Connecting Taxpayers With Tax Professionals

3 Ways To Be Eligible For The Irs Fresh Start Program

Man Owes 1 Million In Back Taxes Irs Fresh Start Program Could Have Saved His House And Assets

Desperate For Revenue Connecticut Revenue Services Blasts Out Fresh Start Audit Letters

3 Ways To Be Eligible For The Irs Fresh Start Program

How The Irs Fresh Start Program Can Get You Back On Your Feet

Best Tax Relief Companies Top 6 Tax Debt Resolution Services Of 2022

Fresh Start Initiative Review A Tax Relief Service Lendedu

Follow Irs Fresh Start Initiative On Other Platforms Fresh Start Social Media Irs